COVID-19's impact on financial services brand experiences

How COVID-19 has impacted customer and client behaviours and what it means for how FS brands and their experiences need to evolve

There’s been a lot of noise around the tactics marketers have been using to manage the here and now – but much less about how to plan for the longer term impact on experiences.

“COVID-19 has shifted the context for both consumers and FS firms, creating challenges but also some real opportunities for brands in the future”

John Riley, Strategy Director at Clear M&C Saatchi

So in July, continuing our successful partnership we hosted a webinar with our friends at the Financial Services Forum, bringing together marketing leaders from FS organisations to discuss the impact of COVID-19 on financial services brand experiences.

The discussion was moderated by Geraint Jones, Global Marketing Director at Clear M&C Saatchi and featured:

- Nicole Zimmerman, Head of Customer and Marketing and Western Union Business Solutions

- Will Kingston, Head of Customer Experience at Close Brothers

- John Riley, Co-Head of Financial Services at Clear M&C Saatchi

- Helen Danzey, Senior Conference Producer, The Financial Services Forum

You can watch the whole session back here:

John began the session by discussing the changing context for both consumers and FS firms due to the COVID-19 crisis.

From a consumer perspective, squeezed finances, lack of consumer confidence and uncertain job prospects has created an environment of anxiety about their financial futures in addition to fear about the health crisis. On the other hand, for financial services organisations, the already rapid pace of digital transformation has accelerated as consumers move en masse to digital channels. Additionally, many firms laying off significant numbers of employees means that delivering high quality experiences will become even more difficult with stretched staff.

All of this is happening in the context of an already difficult environment in terms of finding returns exacerbated by the crisis which has made investing in brand experience a challenge.

This paints a picture of rapid change and immense challenge, making managing brand experience, an already tricky feat, even more daunting.

COVID-19 and four shifts in brand experience

John highlighted four shifts in brand experience considering the COVID-19 crisis. These shifts were informed by fresh research commissioned by Clear M&C Saatchi, examining consumer perceptions of the promises brands in the Financial Services sector, how well they think brands are delivering against those promises and a general understanding of how their needs have evolved over time. The research, and a broader understanding of the FS landscape, reveal the following shifts:

1. How consumers engage

There has been a rapid and significant shift to digital channels during COVID-19. And we don’t expect this to shift back any time soon. Data show this looks to be a behaviour that will stick post-COVID. Our study shows app/website usage increased by 45% during the peak first wave of COVID-19 (vs 2018) with bank branch interactions significantly down. Further research from Virgin Money in May shows that 83% of consumer plan to continue to use digital banking after the crisis

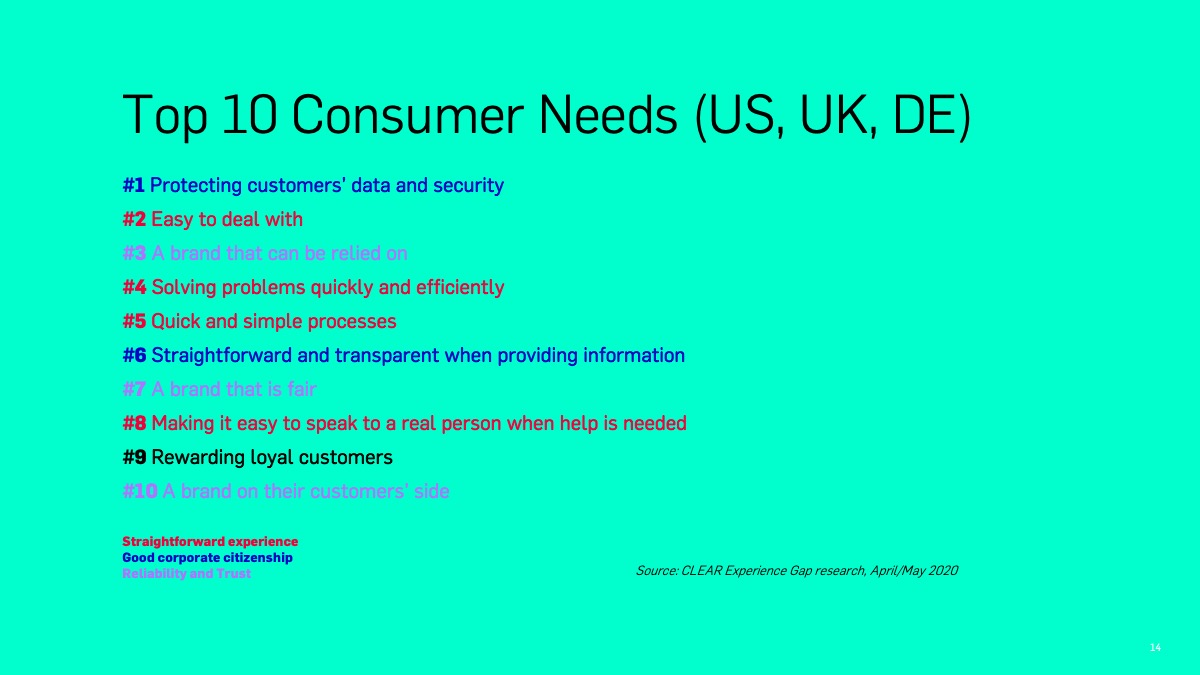

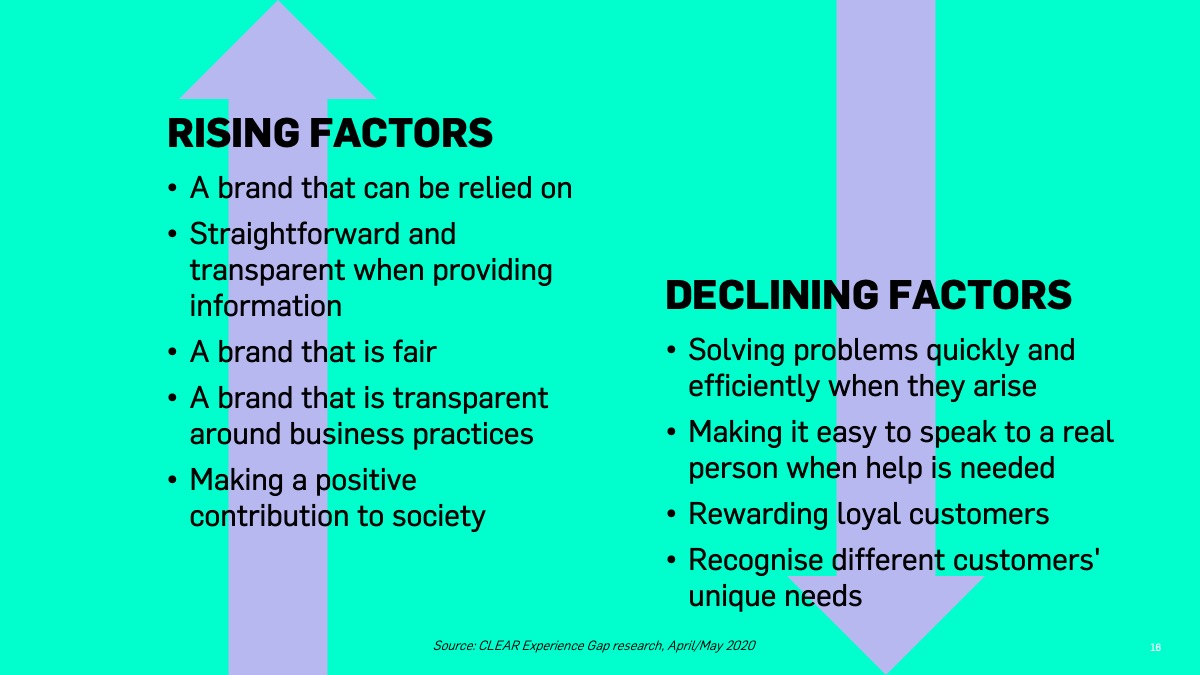

2. What consumers care about

We’ve seen some major shifts in FS consumer needs since COVID-19 hit. Consumers are prioritising three key factors in the post-COVID world:

- A straightforward experience

- Good corporate citizenship

- Reliability and trust

COVID-19 has made people more utilitarian in their needs. Far from bells and whistles, consumers are looking for brands to follow through on their promises and get the job done.

3. What consumers expect from FS businesses

COVID-19 has accelerated an already existing trend – the importance of trust and purpose and highlighting the demonstrable ways you make a positive impact in the world. Particularly in FS, where the industry is not the cause of the crises, COVID-19 presents an opportunity to live up to purpose. Words aren’t enough. Brand purposes & promises are being tested like never before. Stressed consumers are asking for the support you promised you would provide – and want to see this tangibly demonstrated.

4. The pace of transformation

COVID-19 has been a real acid test of agile innovation. Practically overnight, internal teams have shifted to remote digital working. And staff have managed a difficult transition to serving customers solely through digital channels. Digital transformation programmes that would normally have taken years, have been successfully achieved within a matter of weeks.

Is COVID-19 a wakeup call to the necessary fusion of brand and customer experience?

The panellists agreed that COVID-19 had shaken up the financial services sector and that trends seen in the short term, such as an increased usage of digital channels, would be enduring after the crisis. Nicole noted that at Western Union, the shift to digital had been fast and dramatic and had forced them to consider brand experience via digital as a primary channel to engage consumers.

Will agreed that the crisis had pushed FS firms to focus more on a digital brand experience, but also pushed these firms to think more holistically about value propositions.

“How do we go beyond offering home loans, to helping people move house?”

Will Kingston, Head of Customer Experience at Close Brothers

More than a wake up call about the fusion of brand and experience, the panellists articulated the crisis as an opportunity to think beyond product and move to a more holistic approach to adding value to customers, enabled by a branded digital experience.

Even beyond banking and payments, the panellists agreed that the broader category was in desperate need of evolution, and to use out of category benchmarks as the goal because they are leading in terms of digital experience.

“The FANGs are doing this better and inevitably they are going to enter into the FS space.”

Will Kingston, Head of Customer Experience at Close Brothers

There are also implications of the shift to digital in a B2B context.

“The pandemic has helped us understand how critical good information is to make decisions”

Nicole Zimmerman, Head of Customer and Marketing and Western Union Business Solutions

Nicole went on to explain how Western Union Business Solutions go to market had shifted overnight from in person events to connecting via content and traditional channels like phone calls. This has been enabled by digital but led by the core of their proposition – being a trusted partner to their clients to navigate change and ensure international payments are made on time in a crisis.

All saw a proactive approach to thinking through how the experience needs to evolve, while keeping the brand promise with eye to adding real value to customers and consumers is even more critical in a digital world.

How can we create a distinctive experience in a post-COVID, digital first world?

The panellists then turned to the question of how to remain distinctive in a world of similarly slick digital apps. The group agreed that this was indeed a challenge but called out a few strategies to avoid a race to commoditization.

“The first step is to be needs based in your digital innovation”

John Riley, Strategy Director at Clear M&C Saatchi

John went on to discuss how brands can expand their value propositions, leveraging ecosystems and partnerships, to create more distinct digital experiences, echoing earlier points about serving needs rather than simply selling products. He also discussed the role of brand personality and tone in maintaining distinctiveness, calling out brands like Ola in the ride hailing space and Betterment in investments as good examples of slick, digital propositions with distinctive flair.

Will called out the importance of being clear eyed and honest when understanding the core of your brand and avoiding the temptation of trying to be something you’re not, especially in the digital layer. At Close Brothers, this means delivering on their three experiential principles – service, expertise, and relationships – consistently across the experience and being intentional about how to balance digital and analogue in service of the customer.

“A big part of driving the distinctiveness of the experience is in how we empower employees and make them own a specific experience through their client interactions.”

Nicole Zimmerman, Head of Customer and Marketing and Western Union Business Solutions

Nicole emphasised the need to provide a clear framework but also to provide flexibility for customer facing staff to empathise with those customers and deliver your distinct value proposition in a way that is tailored to individual client needs. This was called out as specifically critical in a world trending towards more digital engagement.

All agreed that innovation and flexibility to meet existing and new needs in a COVID-19 context was a critical element to remaining distinctive and ensuring that experience gaps are not emerging in the context of an increasingly digital mode of engagement.

What is the role of brand purpose in brand experience in a COVID-19 context?

“The words “purpose” and “campaign” should never be used in the same sentence. Purpose should be driving strategic decision making”

John Riley, Strategy Director at Clear M&C Saatchi

The discussion finally turned to a discussion of purpose and how firms can use purpose to drive strategic decision making in a crisis. The panel questioned the value of advertising purpose, calling out the sea of sameness in campaigns in the immediate wake of the crisis committing financial services companies to being “here for you.” The panel agreed that financial services firms have promised a lot through company purpose statements of late and that this crisis will put those promises to the test. The key challenge cited was the disconnect between those statements and change management tools and structures to hard wire purpose within organisations. Examples such as weaving purpose into project kick offs, quarterly business reviews and identifying areas to embed purpose within the customer experience from an operational perspective were cited as ways to avoid making empty promises.

Nicole cited how purpose is critical to driving the core of Western Union’s decision-making from an operational perspective from a foundational perspective. Importantly, she cited how the firm’s purpose – Moving Money for Better – has been a platform to create new products, offers and services for companies most impacted by the crisis, while also creating a business opportunity for the company.

Panellists also reflected on the data from the experience gap study as well their own experiences to show how consumers have higher expectations of financial services organisations. This trend was cited as something observed pre-crisis, but something being accelerated in a COVID-19 context. Firms have already begun to do this by working with governments to quickly distribute stimulus funds or proactively provide mortgage holidays, but more will be required. Will further sharpened this point by saying that purposeful leadership would require firms to take short term losses to be there for their customers, understanding that this would give them strategic advantage coming out of the crisis.

In the sprit of the important and managing and closing experience gaps, the panel agreed that the future will be about less “saying” and more “doing” to bolster the economic recovery.

Some final thoughts

Amid changing consumer behaviours and shifting expectations of financial services organisations, the COVID-19 crisis is a major opportunity for firms to gain strategic advantage. Whether through meeting new needs with innovative products and services, working with societal stakeholders to meet new systemic challenges or simply making it quick and easy to manage money, financial services organisations have an opportunity to step up and demonstrate they have taken to heart the lessons of the financial crisis.

Brand experience, the interface between consumers and firms, is the primary tool for tackling this challenge, demonstrating value, and creating deeper, more meaningful customer relationships in the long term. In the words of Winston Churchill, “never let a crisis go to waste.”