The next consumer change is coming

Will you be ready?

COVID.

CHANGE.

These two short words sum up a lot of what’s happened to us, our culture, our world, and our companies over the past 18 months.

Quarantine, lockdown, and a fear of the virus outside have resulted in a mass retreat to the sanctuary of home. And while many businesses that operate outside the home have seen a collapse in sales and profits (travel, airlines, and hospitality, to name a few), many brands focused on in-home occasions have thrived – such as those covering household care, cleaning, home baking, and ready meals.

Thrive: category growth during COVID

Vitamins & supplements: +50% [1]

Dishwasher detergents/kitchen cleaner: +40% [2]

Fresh roast coffee: + 30% [3]

Dive: category decline during COVID

Makeup/beauty: -25% [4]

Fragrances: -25% [5]

Gum & candy: -33% [6]

The question we’ve been asking is this: what’s next for those fortunate brands that have flourished as a result of COVID, seeing a rare silver lining from this last year on their bottom line? With lockdown over, can their performance be sustained? And, more importantly, if so, then how?

In an attempt to look forward, we started by looking backwards, drawing lessons from consumer behavior and brand performance since the pandemic began.

Lessons from the pandemic: a consumer journey

Consumer stage 1: Retreat

March 2020 sent us all spiraling back to the bottom of Maslow’s hierarchy of needs – focused on survival and safety. This fear-dominated mentality led to widespread stocking, a startling lack of toilet paper, and consistently empty shelves across stores.

While scary, it wasn’t all bad. This was the moment that led many consumers to rediscover familiar favorites – brands that had fallen out of their consideration set or occasion set.

+70%: US SPAM sales in the 15 weeks to June 13, 2020 [7]

+10%: increase in HHP for Campbell’s Soup Q220 (vs Q219) [8]

Soups, cereals, frozen dinners, even SPAM – brands and categories that many had considered to be out of fashion all grew significantly as they met basic consumer needs and occasions, providing the added emotional benefits of familiarity and comfort.

Brand lesson: Hold onto your heritage and build on your strengths. Remember what functional and emotional needs you tangibly address – tap into them and leverage your strengths.

Consumer stage 2: Discover

Once the shelves had filled up again and fear began to give way to acceptance, consumers started to quickly make the best of the situation and we saw a sense of discovery spread across multiple product categories. From DIY to Culinary Adventures to Virtual Happy Hours, the once out-of-home discretionary income was now being spent in-home, in a big way as needs and occasions changed.

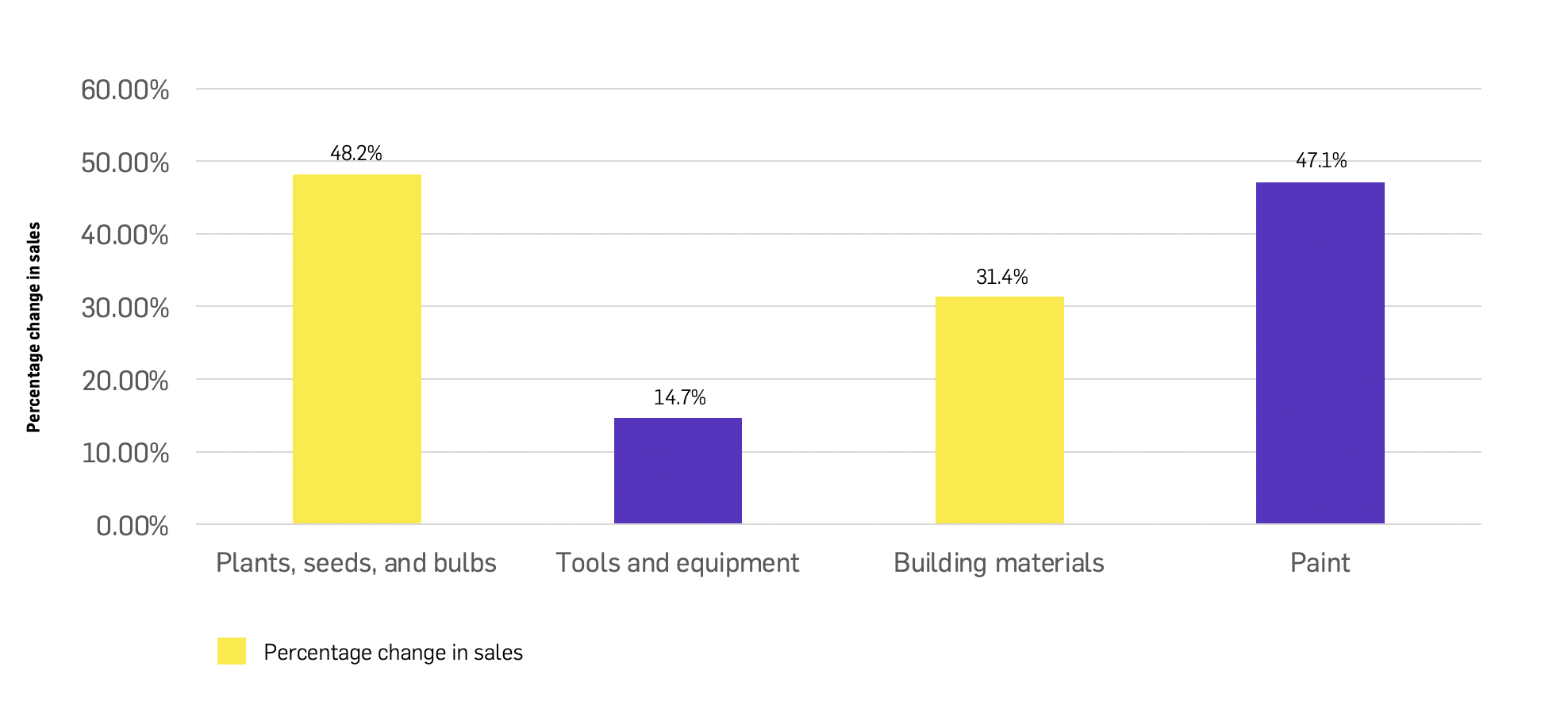

Y-o-y % change in the online sales of gardening and home improvement products in the UK during the COVID outbreak in 2020: [9]

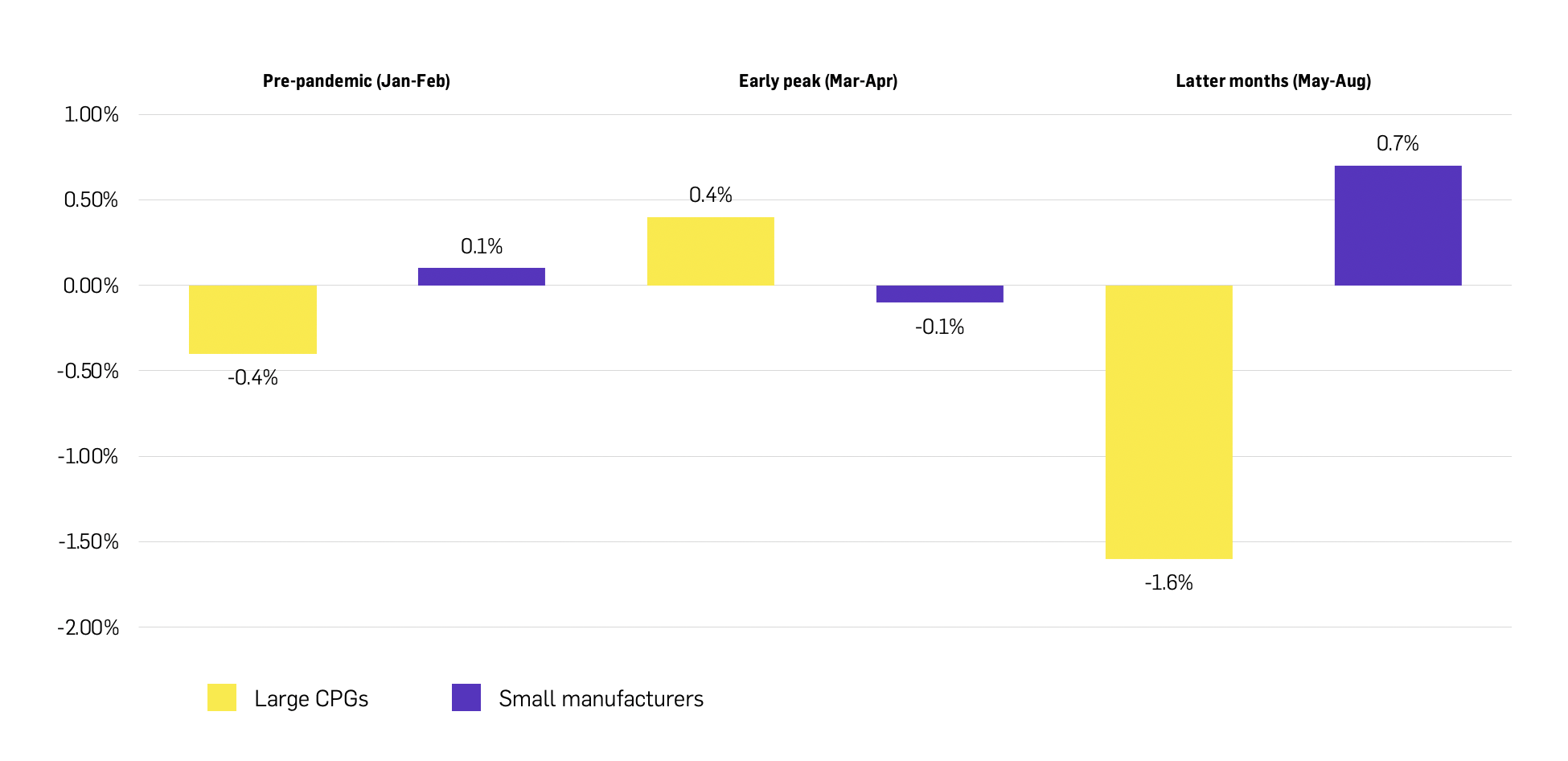

At the same time, with many physical retail outlets closed or brands out of stock, a large, captive audience to appeal to, and reduced barriers to trial, many smaller and D2C brands saw opportunity and growth. Trying something new was never so easy, and consumers were more than happy to experiment with new brands and products to add a bit more spice and variety into their lives.

% share gain/loss of total sales, large vs. small CPG manufacturers, IRI data: [10]

Brand lesson: Flex to fit the consumer context and meet emerging unmet needs. New channels + new occasions + new audiences = new opportunities to generate value.

Consumer stage 3: Scrutinize

As well as looking to brands to meet their basic needs, consumers very quickly began to scrutinize brands’ wider responses to the crisis. In other words, we started to expect brands to do more than simply manufacture products and generate profits.

63% of global consumers surveyed at the end of March 2020 believed that their country would not make it through the COVID-19 crisis without brands playing a critical role in addressing current challenges. [11]

The focus was on action, empathy, and generosity, and the expectation was for brands to step up and support communities that needed it. Accelerating a trend, consumers were beginning to really examine the WHO behind the WHAT – the people behind the brand, the purpose of the company, and the standards they hold themselves to.

Further emphasized by the murder of George Floyd and the Black Lives Matter movement, brands were and are expected to have a voice on what matters to them and the people they serve.

“People will be living and looking in recession times for brands for their value but also for their values. It’s this dual nature of value that has become more prominent.”

– Conny Bramms, Chief Digital and Marketing Officer, Unilever, December 2020 [12]

Brand lesson: Know what you stand for and what you’re prepared to stand up for. Having a voice and not being afraid to use it can build consumer loyalty, trust, and engagement.

Consumer stage 4: Evolve

Despite all the change caused by COVID, there’s one thing about humanity that will always be true: we’re incredibly resilient. The definition of resilient is “being able to withstand or recover quickly from difficult conditions” – the key word in this case being “quickly.”

While many brands, trend forecasters, and political leaders were or are waiting for the “new normal,” consumers have already moved on. There’s no such thing as normal and there’s no new chapter coming; there’s just “onwards.”

Behavior intention post-COVID:

Restaurant curbside pick-up: 30% penetration, half intend to continue post-COVID

Use of digital health and wellness tools: >10% penetration, 70-80% intent to continue post-COVID

Out-of-home leisure: approx. 30% of consumers say they will spend more on in-person restaurant dining, out-of-home entertainment, and travel post-COVID [13]

As people get out of the home more and more, simple trade-offs will be made. Brands and behaviors that have been discovered and rediscovered through the pandemic will only stay relevant to consumers (whether in or out of the home) if they continue to add value, be useful, and fit with new (and old) needs and occasions.

Brand lesson: Constantly look head and seek out new ways to be useful. Continue to innovate in delivering performance and utility, meeting consumers where they’re going next.

Plotting a way forward

Out of the many lessons we’ve learned from the past 18 months, we’ve been reminded that things can change in an instant, and that there are many instances of change in today’s mindsets, moments, and markets.

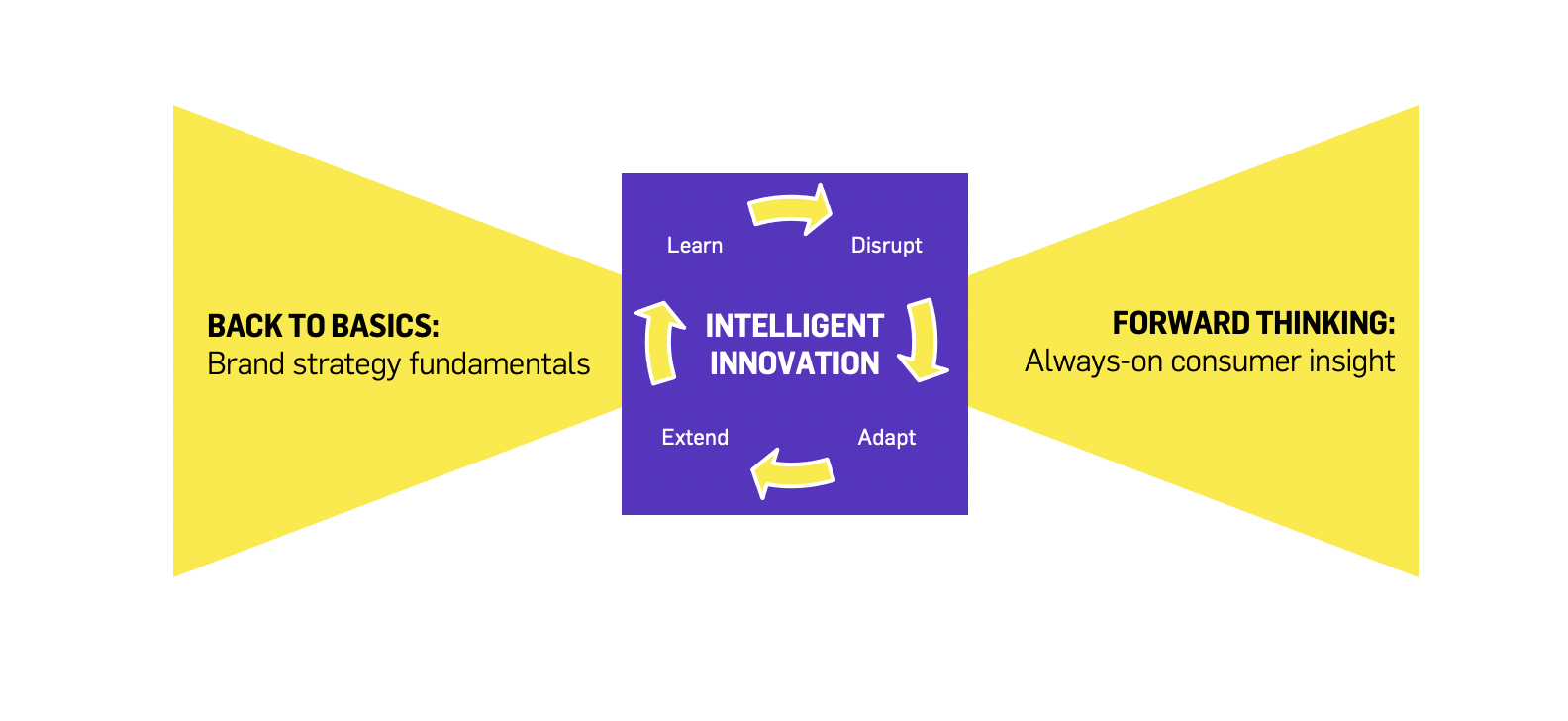

So, to maintain performance and continue to grow, we believe the brands that have been boosted by the pandemic need to focus on intelligent innovation.

Intelligent innovation: two key things to get right

Back to basics: Clear brand strategy

- Know how and why you’re useful: leverage the equity and relationship you’ve built up with consumers over the past 18 months (and the years before that). Know how and why you’re useful and explore new ways to deliver that utility.

- Demonstrate value through the experience: demonstrate your value and values through the brand experience – connecting what you do and why you do it through product, packaging, comms, etc.

- Look outside the comfort zone: understand where you play today and where you could play tomorrow in consumers’ lives – constantly assessing the moments in and out of the home where you can meet the needs of your consumer, now and next.

- An obvious case in point: knowing that consumers will look to public venues for increased and more visible hygiene practices post-COVID, what are the opportunities for B2B distribution and marketing partnerships between hygiene brands and hospitality/leisure businesses? We could see reformulating and repackaging of existing products/formulations to get the right product to market fast.

Forward thinking: Always-on consumer insight

- See ahead of the curve: get a grip on the forces of chaos impacting your category, brand, consumer, and company, get a view on what’s coming next, and invest in disruption before your competitors do.

- Adapt and flow with the data: have a living, evolving view of your brand and consumer, moving beyond moment-in-time research studies to AI-driven analysis of live data sources, providing the ability to spot and react to opportunities quickly.

- Get out in front where and when it counts: map the consumer journeys and explore moments for disruption through new channels and technologies that better meet consumer needs.

- An obvious case in point: out-of-stock challenges in the pandemic increased consumer “preparedness” – what are the opportunities for the launch and growth of subscription-based go-to-market models across core CPG categories that tap into this need?

We believe future-proofed organizations will be built to move – moving ahead of the market and meeting the consumer at the right moment through a meaningful product and brand relationship. As we’ve learned from the past 18 months, the one thing we can always count on is change. Getting ahead of and quickly adapting to that change is the only way to drive future performance and growth. Refocusing on rapid and relevant innovations to the market will be the difference between maintaining share and losing out.

How to win

Our recent work with TikTok, Disney+, Apple, and Amazon has focused on this crucial area of growth planning. These brands have recognized that in order to win, a personalized approach which consistently delivers on highly relevant benefits is required to build a solid foundation of customer centricity. Using that foundation, they’re now building adaptive, customer-first strategies in order to win the battle for relevance post-COVID. Without that flexible, customer-led mindset, brands risk being left behind.

Fancy a deeper dive?

Download the report from our event, “The Next Consumer Change: Will You Be Ready?”, which featured a panel of marketing leaders from Reckitt, Church & Dwight, and Sovos Brands (co-hosted with tml Partners).

[1] Reckitt Benckiser US Sales increase H120 – https://www.jpmorgan.com/solutions/cib/research/covid-spending-habits

[2] Reckitt Benckiser US Sales increase H120 – https://www.jpmorgan.com/solutions/cib/research/covid-spending-habits

[3] Nestle Europe Sales increase H120 – https://www.jpmorgan.com/solutions/cib/research/covid-spending-habits

[4] https://www.jpmorgan.com/solutions/cib/research/covid-spending-habits

[5] https://www.jpmorgan.com/solutions/cib/research/covid-spending-habits

[6] Category decline, Q2 2020 – https://uk.finance.yahoo.com/news/mondelez-cfo-on-q2-earnings-results-and-chewing-gum-sales-165443048.html?

[7] https://www.bloomberg.com/opinion/articles/2020-08-15/covid-19-economic-struggles-send-americans-back-to-packaged-food

[8] https://www.foodnavigator-usa.com/Article/2020/06/04/Campbell-Soup-CEO-highlights-four-ways-COVID-19-has-changed-the-CPG-landscape

[9] Statista – https://www.statista.com/statistics/1107061/diy-online-sales-growth-during-coronavirus-in-the-uk/

[10] https://www.fooddive.com/news/big-cpgs-struggle-to-gain-market-share-during-covid-19-despite-sales-boost/583953/

[11] https://www.forbes.com/sites/hbsworkingknowledge/2020/07/10/what-customers-need-to-hear-from-you-during-the-covid-crisis/?sh=6e4c4cd515ee

[12] https://www.campaignlive.co.uk/article/unilevers-conny-braams-purpose-led-creativity-ecommerce-in-housing-during-covid/1702298

[13] https://www.mckinsey.com/business-functions/marketing-and-sales/our-insights/survey-us-consumer-sentiment-during-the-coronavirus-crisis