Bringing the Consumer in early

Creatives need not apply

The marketing brief comes in, and everyone on the team is pumped. The project is one of those exciting projects your peers get jealous of.

Breakthrough innovation!

You are told it is going to be game-changing to the category and your business. The team wants to stretch into new territories and grab a whole new segment of consumers. They feel this will really strengthen their share and help reach new markets. So now the million-dollar question, what consumers do you test with? Sound familiar?

Having personally come from the client slide, I know there is an eternal debate in research about who to target in early qualitative exploratory work, and how to hone those conversations. As you go through the innovation funnel, at what phase of testing should you be talking with a core target and when do you switch to the general population? Should you include primary purchasers, end users, or brand loyalist? And what about those early adopters? They are perceived as trendsetters and leaders among their friends, right?

Demographics. Psychographics. Typing tools. Segmentations. Algorithms. Do you go for breadth or depth? The list becomes endless, but budgets are not. Research is always about tradeoffs, as there is no perfect research design, note the emphasis on that word design.

Let’s briefly review some of the options

- Early adopters – These are the people that are always looking for something new as they expect something even better must be on the horizon. The question I always ask is, are they going to become integrated into your consumer base or are they just passing in the wind, always looking for the next Mr. Right?

- Creative consumers – They can be of great use when you are dealing with conceptual ideas and you need a beacon through the haze. I’ll be the first to admit, doing exploratory work with creative consumers is fun, really fun! There’s no telling where they will go when given the freedom to explore and let loose. It can be inspiring when you really want to go blue sky, and it can open team thinking. The downside can be cost and leveraging multiple global markets. You have to also temper the team and use the insights cautiously, as you don’t want to end up designing products for just their desires.

- Target audience – You can consider testing with your hypothetical target audience. Or more commonly, we all hear about testing with millennials. You are told they are going to revolutionize your category, so you must speak to them since they are on the forefront of trends. I know from experience you can develop the perfect advertising for a millennial consumer, listen intently about their needs and wants for hours on end, design the ideal product and package for them but at the end of the day, does your business have sustainable volume for them to be the only target you test against? Does any target audience really have enough volume? It might not be the millennial ‘demographic’, but more the millennial ‘psychographic’ you want. Keep in mind a 25 year old can be just as interested in anti-aging skincare as someone in their 50’s, if not more!

- General Population – What about the notion of just starting the testing with gen pop from the onset? They are usually the final audience with whom you conduct volumetric testing to validate your proposition. So for early work, why not just conduct the work with a few age breaks because a 22 year old just out of college must not be able to relate to a mother of three children. Life stages are important to consider, and of course depends on the category, but overall should not be the be all end all definer for qualitative. We are always going to be constrained by budget so conducting multiple groups in early stage work might not be the best use of budget.

We have gone through the gamut of testing, from a very focused cohort to one that is broad and open, in an attempt to obtain reach.

What is the right answer on who to target?

Going after those who are really engaged with the category is my most common recommendation, as this target knows what they want to hire you for and their reasons behind that motivation. They tend to be most familiar with what you are offering and the competitive set, and can walk through the pros and cons to give you that rich experiential feedback, but only if we know how to focus the conversation.

This group already tells us what they want, and they always have since they talk to us indirectly through their wallets. But in exploring new white spaces or offers, we need to provide other ways for them to talk to us that can help us marry the product with the concept earlier before we go down the wrong path and fall into a vicious cycle of testing, revamping, and re-testing.

I like to listen. I have learned a great deal from listening carefully. Most people never listen.

Ernest Hemingway

Anytime you talk to a respondent, they can be a wild card, with you not knowing what tangent they will go off on, or what rabbit hole they can take you down. I feel this is especially true in front end, early-stage fuzzy work. Luckily there are some ways to mitigate this and make sure we build contingencies into the research design.

Most important, we need to change the way we listen, by giving respondents different ways to communicate back to us as we stretch our listening skills.

You can’t fake listening. It shows.

Raquel Welch

Think of it this way, the cost of doing custom research the right way the first time around will always be less costly than having to go back and re-test because something was not properly thought out or planned for. Qualitative is an expensive investment, so careful consideration and over-planning of what stimuli you have at your disposal during those short conversations is critical. Strategically planning out the stimuli in advance can keep you from hearing, “I wish we had…”, “we should have done…”, “why didn’t you….”. You have to go slow to go fast, and that is my mantra!

Now that we know who we want to talk with, we need to plan out that conversation very carefully. We want consumers to enjoy the journey so we should not overwhelm them by asking the same questions over and over. We have all seen respondents just shut down in qualitative because they are tired or exhausted. We should learn to exhaust our stimuli instead, using it more creatively.

The most important thing in communication is hearing what isn’t said.

Peter Drucker

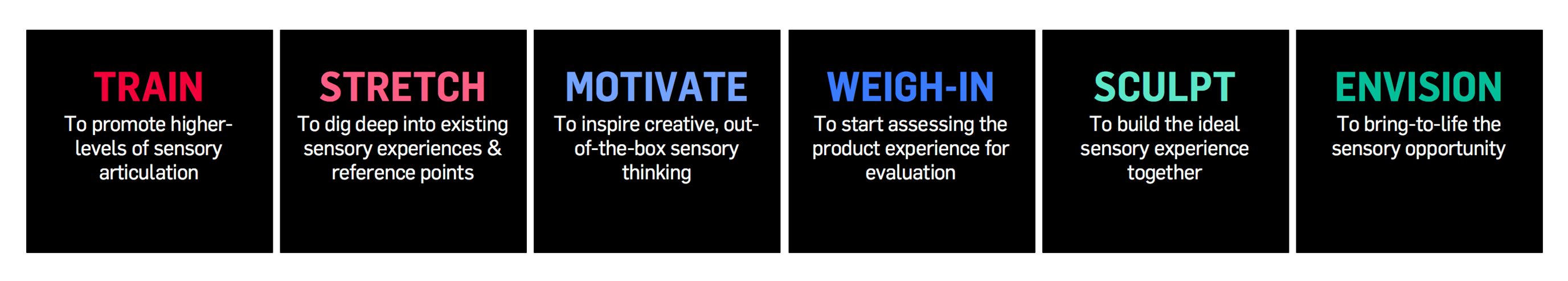

To that end, CLEAR has developed the Sensory Gymnasium, an array of globally pressure-tested sensory enablers that can be coupled together in strategic ways. Their purpose is to exercise and exhaust your insights and incorporate a variety of sensory experiences, pushing learnings into new territories.

These enablers have been curated to provide us with powerful ways to give our consumers outlets to talk to us in non-traditional ways.

In innovation, a robust end to end approach that encompasses insight, sensory & creative with the consumer always at the core is key- and that is our strength at CLEAR.

For more information on the Sensory Gymnasium and how CLEAR can help you workout your sensory challenges, please contact joe.lavin@clearstrategy.com