Diversify or rationalise?

What's the right portfolio optimisation strategy in 2021?

Managing complex brand and product portfolios is tricky at the best of times, and especially challenging in the current economic climate; but a cleverly balanced portfolio optimisation strategy can help drive growth in a challenging market.

Since the start of the COVID crisis, we’ve seen a variety of tactics. Some companies like Coca-Cola started killing brands that aren’t growing shortly after COVID hit, to help cut costs; Unilever started focusing marketing efforts solely on the strongest performers partly because the disrupted supply chain couldn’t keep up with the demand across the entire product portfolio; whilst P&G has been fortunate enough to have good reasons to ramp up the marketing support across the portfolio and boost innovation and manufacturing efforts.

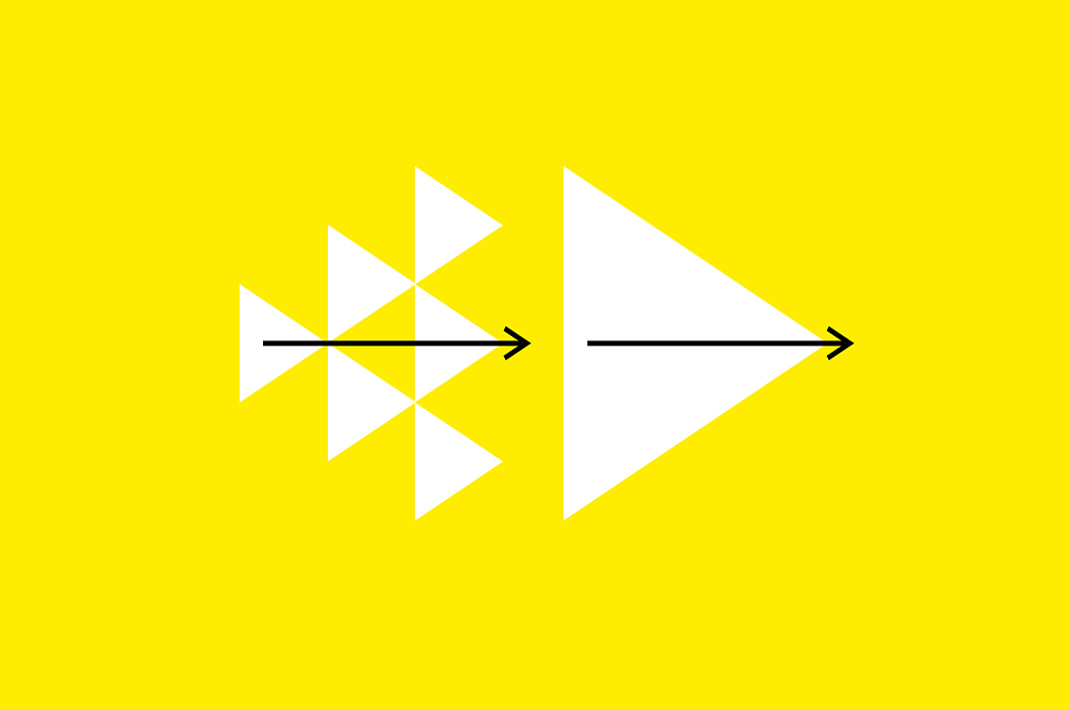

But what’s the right approach in the economic downturn, should you rationalise and focus, or diversify and invest in new areas of growth?

The temptation in a crisis is to rationalise, to cut innovation and marketing spend; however, there’s strong evidence from Les Binet and Peter Field’s studies on marketing effectiveness that this is a short-sighted strategy.[1] Sony was one of many companies that did this when the 2008 recession hit and has struggled to regain momentum ever since. Whilst Lego, Netflix, Dominos, Groupon, Uber are some of the few companies that have invested in new products, geographies and marketing activities to only see profits skyrocket once the peak of the recession died down.[2]

There are two sides to every argument – and in the last few weeks we’ve heard no less respected a voice than Professor Byron Sharp railing against the slew of COVID marketing we saw at the start of the crisis, and instead, seeming to praise Coca-Cola’s decision to pause marketing spend in the UK.

But advertising spend is not portfolio management. An in the moment decision to avoid spending money on low production value, copycat messaged ‘we’re all in this together’ advert at the start of the crisis is not the same as rationalising spend on under-performing sections of your portfolio. One is tactical. The other is strategic.

So, in portfolio management, does looking back to previous recessions help?

We can learn from some of what happened in 2008, but the current economic downturn was started by very different factors and it will be much more selective in terms of who is affected and how. As a result, it will have different brand and product portfolio management implications. Let’s have a look at this from a few different angles.

Category:

Whilst 2008 saw companies struggling across categories, the COVID effect is much more complex. Some companies are finding themselves in a cluttered market space with a significantly reduced demand (e.g. travel, leisure, take away food & drink). Meaning they need to rationalise the core and think creatively about diversification options to have any chance of survival. Others are operating in growing categories (e.g. healthcare, in home entertainment, delivery services), but this bears the risk of lots of new entrants and a significantly decreased share of the market[3]. Meaning even the less affected companies need to be super tuned into the shape of the competition AND streamline even the most successful portfolios to make space for relevant new news.[4] All to ensure the offer stays focused, relevant, different and salient in the midst of the economic turmoil.

Consumers:

During and post-COVID many of us will be restricted financially, just as we were in 2008-10 when we witnessed a strong resurgence in private label. However, the shifts in consumer behaviours, attitudes and needs have been much more dramatic this time round. There’s less mistrust in big brands and a rapid acceleration in certain trends, especially those linked to health & wellness. For example, trends like prevention which might have looked like a fad a year or so ago, now feel like a genuine and large consumer need – worth investing in not only to attract new consumers but to retain the existing ones too. Therefore, companies that invest in understanding their audience and in how their needs have evolved, will have much stronger and clearer reasons for both divesting certain offers and investing in new growth areas, far beyond the better value propositions.

“There is a balance of ensuring the business continues the volume driving products to keep the cash flow running smoothly but at the same time to allow diversification in order to take the opportunities which arise from changing consumer behaviour. Throughout a period of flux one should make sure new products are developed & launched to make the most out of opportunities which are presented”

– Alex Wright, Dash Water

Channel:

Recession can be an opportunity to get closer to your customers if you are able to show that the changes in your portfolio have been made by taking into account their shifting needs. This would have been an option in 2008 and is a clear option in 2020/21. However, now both large and small brands have other channel levers to pull. There’s an opportunity to move the conversation beyond the strength of your product portfolio, especially if it isn’t big or strong. Invest in and emphasise the richness of the omnichannel brand experience that goes beyond what’s in the product, on the pack and in the store to gain trust and a competitive advantage in the eyes of your customers. And there’s a huge opportunity to diversify not only in terms of products but in terms of how they reach the end consumer (i.e. growth in e-commerce, direct to consumer propositions).

“Our portfolio is very small and the focus has always been on Core SKUs – we are not able to innovate as fast as the likes of P&G. Despite this, the changing market landscape off the back of COVID-19 has meant strategy pivots for us too. This has very much been channel focused though, rather than portfolio. As we saw our on-trade business close overnight, the focus became on maximising presence in retail and obviously online and how we could offer consumers the on-trade experience at home.”

– Henry Dunn, Seedlip

Portfolio and brand management in 2020 is a much more complex undertaking than it was in 2008. Successful companies will need to both rationalise and diversify in different ways to protect and future proof their brands. And they are more likely to take the right course of action with an agile strategic approach – keep analysing the most recent dynamics in the category, keep tracking emerging consumer needs, and keep tapping into various omnichannel experience options that are opening up.

When rationalising, do this first:

- Step back and consider short term gains and long-term risks, to ensure current moves don’t jeopardise your performance once the worst of the crisis is over. It’s easy to cut, harder to grow.

- Invest in new consumer / customer insight which proves that certain areas are not worth investing in (as opposed to commercial performance numbers alone)

- With the objective of staying focused and salient; consider carefully how and when to advertise – and as Sharp says, make sure you remain distinctive

When diversifying, do this first:

- Invest in understanding genuine current and future consumer / customer needs

- Embrace agile methodology – innovate and test iteratively based on the most recent understanding of the category, consumer and channel dynamics (as it’s too early to predict which market shifts will be relevant in 2021/22)

- Think holistically – consider the entire consumer experience journey and levers that could be pulled beyond the product, pack and physical store experience alone

The brands that do this will emerge from the chaos of 2020 stronger, leaner and with a clearer focus on where growth will come from in 2021 and beyond.

——————————–

[1] Binet & Field, found in their 2008 study that cutting budget in a downturn may help to protect profits in the short term but, as a result, the brand would inevitably be weaker and much less profitable post-recession.

[2] 2-year research piece by Harvard business school examining the performance of 5,000 companies before, during and after the 2008 recession found that the organisations that thrived post-recession weren’t the ones that turned to dramatic and deep cost-cutting

[3] “Share of top three brands in hand sanitiser dropped from 85% in January and February to 39% in March after 152 new players entered the segment. In packaged rice in modern trade, top three brands cumulatively lost their share from 72% in February to 64% in March” – Nielsen

[4] “About 65% of the consumers have tried new or alternate brands, of which nearly 10% intend to not switch back” – McKinsey