Goliath & David - the big and the vulnerable

How vulnerable is your category to insurgent brands?

In today’s market, even the most established brands are vulnerable to small, nimble insurgents. A new Clear study finds that anticipating change is the first step to a successful response.

Barriers to entry are crumbling—and so is the status quo. How vulnerable is your category? Without an in-depth look at consumer attitudes and the success of insurgent brands, you’re at a serious disadvantage.

Turbulence on the rise

Change has only become more rapid in the 17 years that Clear has been crafting marketing strategies—and emerging trends seem to indicate that there’s more to come.

- Anti-establishment is the new norm. In major political shifts, Britain turned its back on the EU, and the US rejected the status quo. These developments defied predictions of experts in the field. Similarly, new brands are gaining ground by bucking tradition with alternative offerings.

- We love the underdog. Market success for small brands was once an uphill battle. They now enter the field with a significant advantage: consumers embrace newcomers and value their niche offerings.

- Barriers to entry are dissolving. With social media, effective marketing is now doable on a limited budget, and traditional retailer networks can be bypassed. Insurgents are steadily advancing on dominant brands.

- We don’t always know what we want until we have it. Customers’ needs can be elusive. A new offering from an outlier can trigger a groundswell of consumer demand that once lay dormant.

- Strength in numbers. Collectively, insurgents can constitute a tough adversary for even the biggest brands, eroding their sales and even their image.

In response to this ongoing turbulence, CLEAR conducted a study in which we spoke with 2,500 consumers across the US and UK, gathering feedback on 200 brands in 19 categories. We found that many categories, to different degrees, are vulnerable to insurgent brands. What’s more, these newcomers can foster an anti-establishment consumer mindset, further weakening category leaders.

A wake up call

Brand loyalty, once a powerful strategic advantage, is now overmatched by evolving and unpredictable consumer needs.

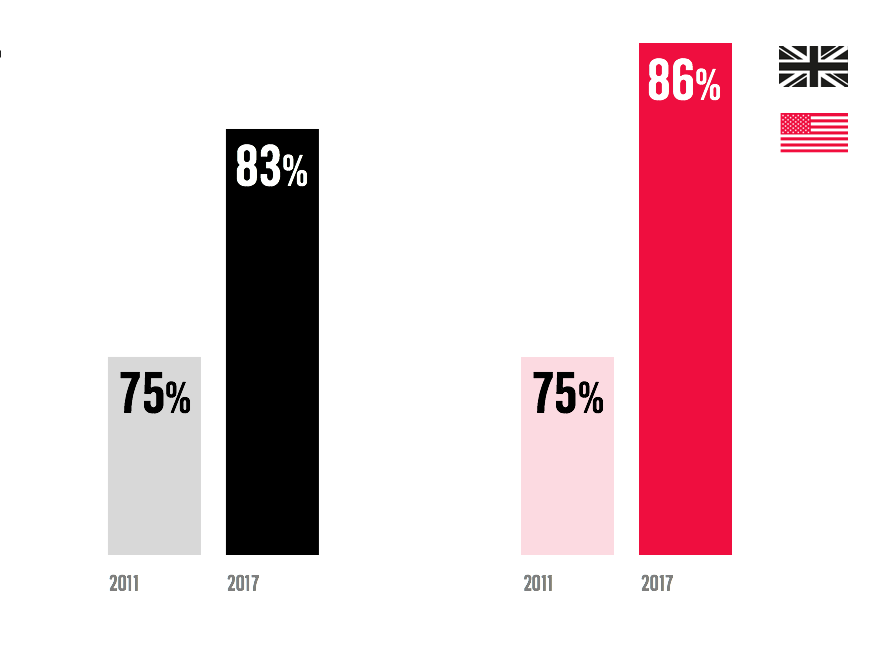

In a 2011 Clear survey, 75% of US and UK consumers had begun to seek out brands based on their attributes, rather than their status—regardless of category. Recently, those numbers jumped to 83% in the UK and 86% in the US.

By recognizing and exploiting this shift in consumer mindset, insurgents are gaining ground on established brands. And it seems that consumers welcome the change. 32% of consumers state that they “love to see new brand offerings,” and 41% were highly motivated to try them.

What’s more, as options expand, so does consumer demand. Features such as “natural” or “hand-crafted” have become formidable drivers pushing consumers toward insurgent brands— if not addressed, the financial implications can be considerable. For example, in the UK, the chocolate category risks up to £3,300 million; in the US, that number rises to $8,844 million.*

Know where you stand

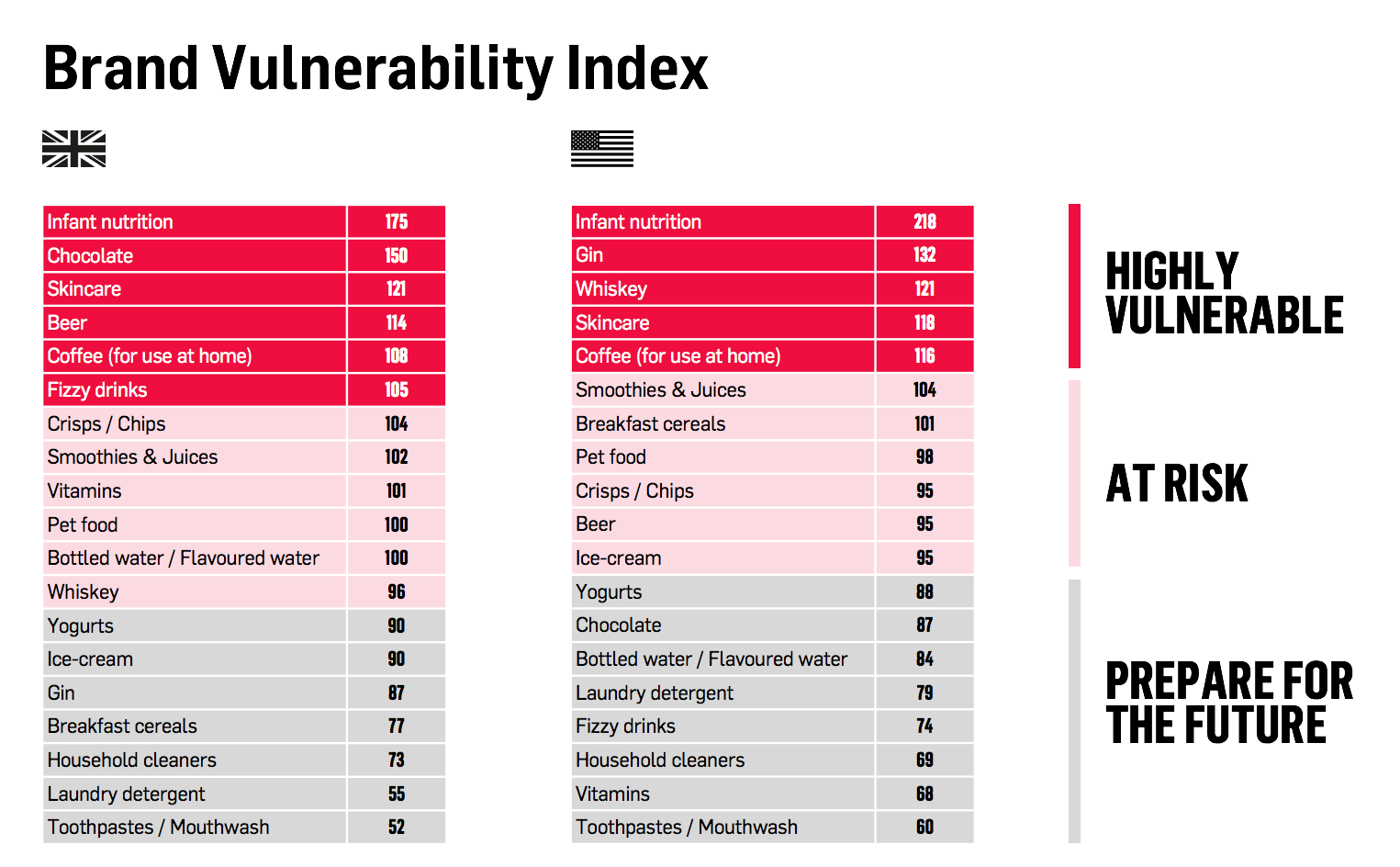

Categories can be placed in three tiers: Highly vulnerable, At risk, and Prepare for the future: know where your category falls.

Consumer attitudes directly contribute to the vulnerability of categories. The Clear study looked at the following behaviours as major drivers:

Contemplation. The consumer considers the need to try a new brand.

Awareness. The consumer is aware of other options in the category.

Engagement. The consumer enjoys seeing alternative brands and seeks them out.

Activation. The consumer tries new brands.

When these factors are measured, it can easily be seen which categories are at risk.

The following case studies show where key categories fall within the tiers of vulnerability, and the shifting market dynamics that put them there.

Infant Nutrition

Several factors place infant nutrition in the high-risk category. New parents are highly engaged, but only for a snapshot in time, virtually negating brand loyalty. Furthermore, insurgent brands tend to project a caring, homespun image; big brands seem inauthentic by comparison.

Gin

The stability of the gin category in the UK versus the US shows that culture plays a pivotal role in the market. Big brands established gin as a favorite among UK consumers, and they enjoy a good measure of brand affinity as a result. Conversely, the Gin category has not reached the same level of maturity in the US—as a result, new brands easily find openings.

Carbonated Soft Drinks

CSDs also face different threat levels among UK and US consumers. In the UK, customers perceive a flood of new brands entering the market. Coupled with a healthy skepticism of big brand authenticity, these insurgents put CSDs at high risk in the UK. In the US, despite seeing category decline, the majority of CSD consumers are still turning to the big players when they do look for a fizzy treat —creating the illusion of stability for the short-term.

It’s easy to see that many factors are at play in the new market, where change is the only constant. To position your brand on solid ground, keep the following watch outs in mind.

Niche offerings are no longer fringe offerings.

Once insurgents establish a foothold in a category, their very presence can act as a Trojan Horse of sorts, driving new consumer demand from within. Our study found that even as insurgent brands consistently deliver attributes cited as “less important,” these offerings pave the way for the brand to establish itself, gain visibility, and potentially broaden its appeal to consumers.

Past success does not equal future success.

It can be tempting for big brands to reject trendy attributes like “natural” and “healthy” and rely on traditional tablestakes. But in today’s market, consumers seek brand responsiveness—stick with the status quo, and you risk coming up short in their eyes.

Prepare for the future means just that

Even low-risk categories must be on their guard. Our findings reveal that the demand for features like “natural” and “safe for everyday use” are surpassing even rock-solid efficacy credentials in categories like household cleaners, oral care, and laundry.

Can you imagine a 2017-launched insurgent brand in automotive, retail, food and beverage, fashion, that didn’t claim to be in some way superior to the incumbents when it comes to the environment, society, ethics, personal health, or some other impact metric?

– Trend Watching, March 2017

No category is immune from the threat of insurgent brands. They are handily flipping the narrative and driving consumers to raise their expectations and focus on exactly what they want from brands. There’s no refuge to be had in name recognition or maintaining the status quo.

*based on Euromonitor data